Want to get more information on Nations and Regions Investment Funds?

Register for our newsletter and get the latest updates on our Nations and Regions Investment funds.

Register for our newsletterOpen for applications

Equity Finance Up to £5 million

Equity finance is widely accepted as an important ingredient for businesses with potential for high growth.

Equity finance can be particularly important for new and innovative companies with high growth potential as it can provide long-term backing to fund business growth through to revenue and profit. In simple terms, equity finance is raising capital through the sale of shares in a business.

The Investment Fund for Scotland has particular interest in supporting equity investments, helping the Nation to become a vibrant and sustainable venture capital market. An equity-based investment could be right if you run an established business with ambitious plans, or a large start up with high growth potential.

How it works

- Go to the fund manager’s website by clicking the box below.

- Make an enquiry directly to the fund manager.

- The fund manager will contact you to talk through your funding requirement.

- The fund manager may ask for more information and a formal application or pitch deck.

- The fund manager will evaluate your application and make the investment decision.

Have a question? Read our Frequently Asked Questions.

Funds Available

Latest news from the Investment Fund for Scotland

Press release

Blog post

Press release

Investment Fund for Scotland in the news

Edinburgh-based User Vision secures six-figure investment

08 September 2025

User Vision, a Scottish consumer behaviour consultancy, has secured a six-figure equity investment from the Investment Fund for Scotland through fund manager Maven Capital Partners. The funding will be used to support new leadership and growth plans.

Learn more About Edinburgh-based User Vision secures six-figure investmentAilsa Reliability Solutions Ltd secures £500k loan

19 May 2025

Kilwinning-based tech business Ailsa Reliability Solutions is expanding its workforce, improving software and meeting increasing demand for its asset and plant monitoring service, thanks to a £500k loan from Investment Fund for Scotland partner the FSE Group.

Learn more About Ailsa Reliability Solutions Ltd secures £500k loanIFS Maven Equity Finance invests in microbiology services provider

29 April 2025

Dyce-based biotech company NCIMB is scaling its operations and tackling some of today’s most urgent scientific challenges thanks to £1.7m of equity funding from IFS delivery partner Maven Capital Partners and the Scottish National Investment Bank.

Learn more about IFS Maven Equity Finance invests in microbiology services providerInvestment Fund for Scotland Case Studies

Podfather

Cloud-based logistics software business Podfather received a £3.4 million investment to support their ambitious growth strategy.

Sky-Pin Drones

Melrose-based entrepreneur offers advanced crop spraying services using state-of the-art supersized drone following funding from the Investment Fund for Scotland.

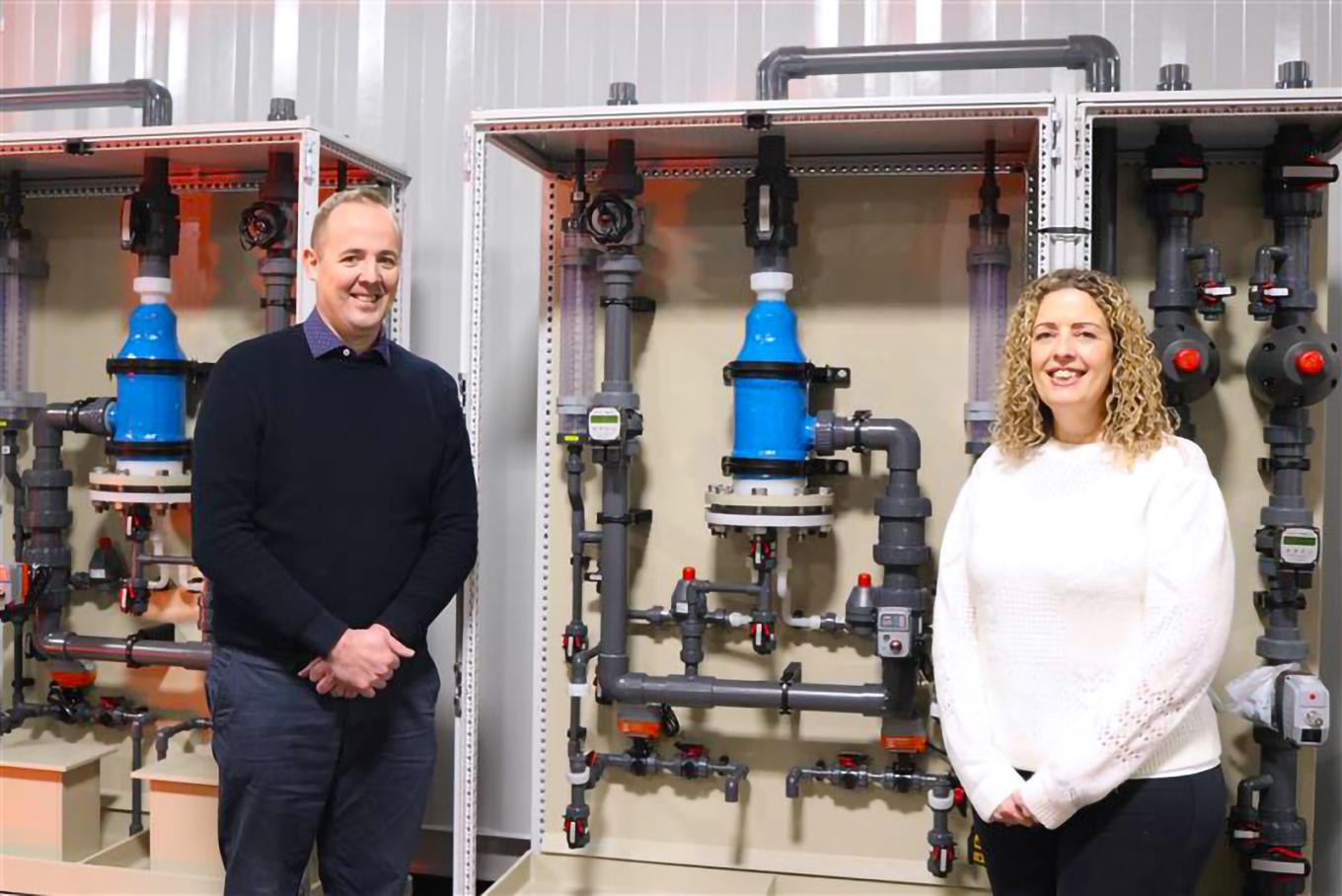

Scotmas

B-Corp accredited specialist water treatment technologies business, Scotmas secured £2.2 million in equity funding to support its international expansion plans.

Sign up for our newsletter

Just add your details to receive updates and news from the British Business Bank

Sign up to our newsletter