Success Story

| Region/Nation | Yorkshire and Humber |

|---|---|

| Programme | Bounce Back Loan Scheme (BBLS) |

| Partner |

Like the rest of the hospitality industry, this microbrewery had no option but to close its doors once the government lockdowns began. With its income massively depleted, and serious concerns over its ability to survive the pandemic, the business sought financial support via the Bounce Back Loan Scheme (BBLS).

Read what it had to say in this BBLS case study.

British Business Bank: Can you tell us what your company does?

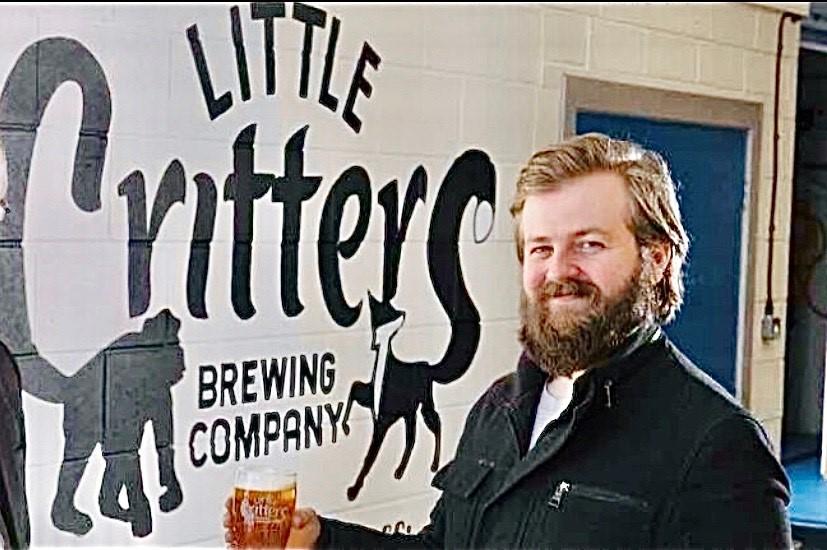

Matthew Steer, managing director of Little Critters Brewing Company: It all started in 2012, when we took our love for cask ales and our dream of opening a microbrewery and started the addictive journey of home brewing in the kitchen at home. Fast forward to early 2020, and we’re settled in our unit in the Kelham Island area of Sheffield and continuing to grow the business with new processes, new kit, new recipes and a stable plant with a great team.

How did COVID-19 affect your business, and why did this mean you needed funding?

The lockdowns to tackle the spread of coronavirus have completely shaken the hospitality industry, and our business was among the many victims. As soon as the government closures came into force, we had to close the brewery, which meant we lost all our income aside from what we were making from our online sales. This had a big impact on our cashflow, and we were concerned about our ability to survive.

How did you find the application process?

Once we decided to approach Barclays about the Bounce Back Loan Scheme, we completed our application, and received the £50,000 of funding we needed, all in the space of 48 hours.

We’ve invested heavily in the business over the last couple of years. With the Bounce Back Loan, we’re now confident we can survive these challenging times and return to profit when more normal trading returns. - Matthew Steer managing director of Little Critters Brewing Company

In what way did the funding help your business survive?

Setting up Little Critters has been a dream come true for us, so we were thrilled when we were able to access a Bounce Back Loan. We’ve invested heavily in the business over the last couple of years and, with the loan, we’re now confident we can survive these challenging times and return to profit when more normal trading returns.