What is the Small Business Equity Tracker?

The tenth annual British Business Bank Equity Tracker report examines recent trends in equity investment into UK SMEs and the international competitiveness of the UK VC market. The report also assesses the UK’s VC market gaps and Bank activity in the market.

This is a summary of key findings and conclusions from the 2024 report. Read more on the full report.

Why does equity finance matter?

Equity finance is a driver of high growth. Innovative companies can respond quickly to new opportunities created in the market and help address emerging and long term global challenges.

About the British Business Bank

The British Business Bank is the UK’s economic development bank. Our mission is to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by supporting access to finance for smaller businesses. The British Business Bank delivers a range of both debt and equity programmes, ensuring that small businesses can access finance that is right for their needs at the right time

Snapshot summary

Following the market downturn in the middle of 2022, equity investment for smaller businesses has fallen to levels previously seen in 2019

- The Bank has supported 15% of UK smaller business equity deals between 2021-2023, with a high proportion in tech companies and university spinouts

- Over the past decade the UK has overtaken India as the third largest VC market in the world, now accounting for 5.8% of global investment

- The UK now attracts over 11% of global fintech investment, and has also increased its market share in software, green tech and deeptech sectors

- he UK has narrowed its overall market gap with the US, but sectoral gaps remain in life sciences and deeptech industries

Key findings

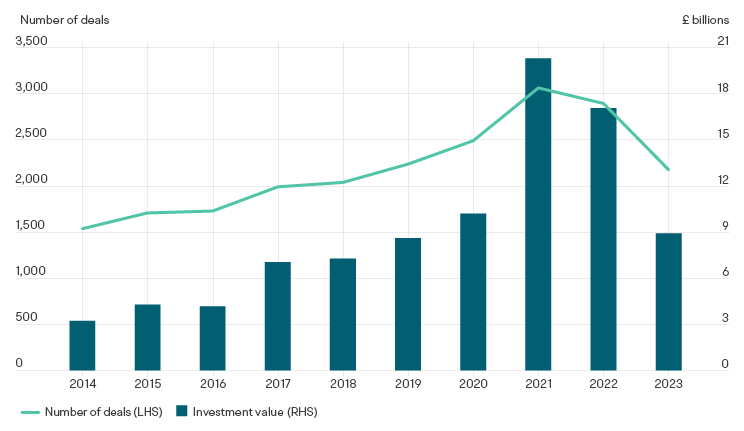

Recent Trends in SME Equity Finance

- Equity finance for smaller businesses fell by 48% in 2023, following record levels of activity in the previous two years

- The number of deals also fell by 25% in 2023 to around 2,150

- In a historical context investment is still 182% higher than a decade ago

- Quarterly investment levels are appearing to stabilise in 2023, in line with more sustainable levels seen before 2021

- There was an increase in funding for growth stage companies in the second half of 2023, with investment 25% higher than in 2023H1

- The average equity deal size fell overall in 2023, however, the second half of the year showed some initial signs of recovery

- The number of deals declined across all regions and devolved nations in 2023, though activity in the East Midlands and Wales was the most resilient

- University spinouts raised £1.3bn in 2023, equivalent to 15% of total investment across the UK market

- Female-founded companies received a record share of deals in 2023, but continue to receive a smaller proportion of investment

Annual number and value of SME equity deals over time

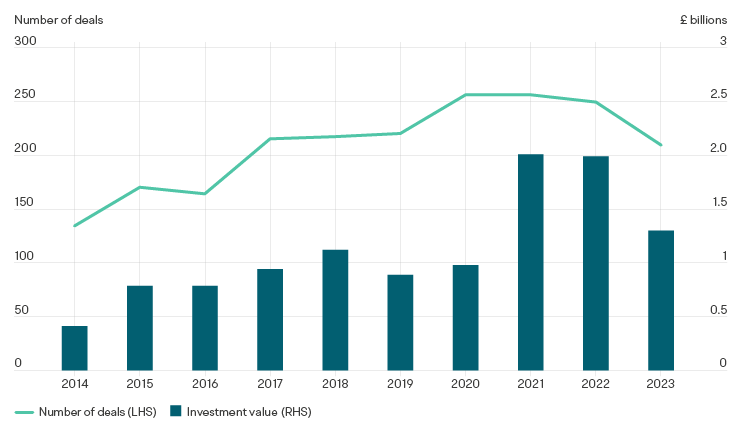

Proportion of announced equity deals by stage in 2021-23

British Business Bank Activity

- The Bank’s equity programmes supported around 15% of UK equity deals between 2021 and 2023

- British Business Bank supported funds are more likely to undertake deals in seed and venture stage companies compared to the overall market

- Funds supported by the Bank were more likely to invest into technology/IP-based businesses than the overall equity market

- Compared to the wider market, the Bank allocates a greater share of its equity deals to eight of the twelve UK nations and regions

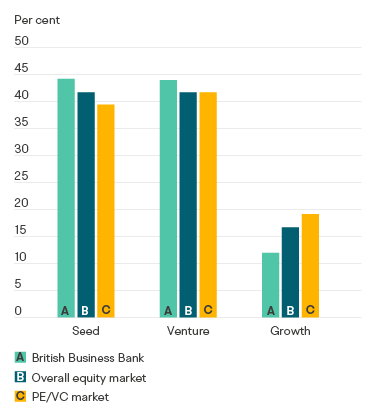

International competitiveness of the UK VC market

- The UK has overtaken India as the third largest VC market in the world, now accounting for 5.8% of global investment

- The UK is also the third largest market for deal numbers, though other countries have made greater progress over the past decade

- While fintech remains its biggest strength, the UK has become more competitive in software, green tech and deeptech sectors

- The UK’s pipeline of early-stage innovative companies is growing faster than the global average

- The UK is the fourth largest market in the world for unicorn companies. However, it is less efficient than key competitor countries in producing these businesses

- While the UK’s leading clusters are in the Golden Triangle, other cities have developed their own sector specialisms

Share of global VC investment by country, 2014-16 vs 2021-23

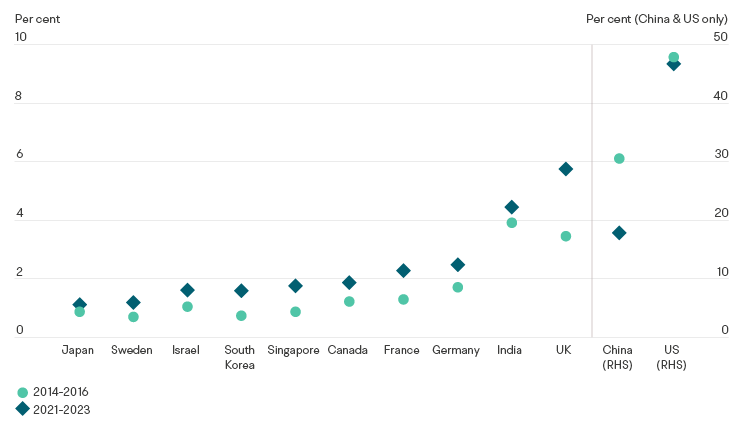

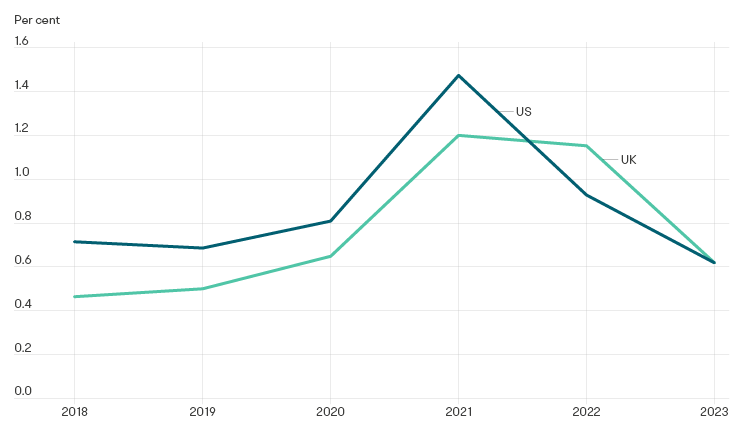

UK and US VC investment as a proportion of GDP

Assessment of the UK’s VC market gaps

- The UK has narrowed its VC investment gap with the US, though this has partly been driven by cyclical factors

- While the UK outperforms the US in fintech, investment gaps remain in life sciences and deeptech sectors

- UK companies have been more successful at progressing to later funding rounds than their US counterparts. However, they raise considerably less on average than US companies, particularly at later funding rounds

- Green tech-focused companies are well funded at earlier stages, but fall behind the wider market after their second round

Get in contact

If you would like to meet to discuss the British Business Bank’s work backing innovation and breaking down barriers to small business finance, please contact us below:

Public Affairs email us