What is the Small Business Equity Tracker?

The ninth annual British Business Bank Equity Tracker report examines recent trends in equity investment into UK SMEs. This year’s report also examines UK strengths and opportunities in breakthrough technologies.

This is a summary of key findings and conclusions from the 2023 report. The full report can be accessed here.

Why does equity finance matter?

Equity finance is a driver of high growth. Innovative companies can respond quickly to new opportunities created in the market and help address emerging and long term global challenges.

About the British Business Bank

The British Business Bank is the UK’s economic development bank. Our mission is to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by supporting access to finance for smaller businesses. The British Business Bank delivers a range of both debt and equity programmes, ensuring that small businesses can access the finance that is right for their needs at the right time.

Snapshot summary

- UK SME equity finance declined by 11% to £16.7bn in 2022, driven by a downturn in market conditions in the second half of the year which has continued into 2023.

- While the Bank’s overall share of equity finance has fallen slightly in 2022, it remains more likely to invest in tech companies and university spinouts than the wider market.

- FinTech, Software, Life Sciences and AI all stand out as areas where the UK specialises and is globally competitive in attracting VC investment.

- Looking at future opportunities, the UK can capitalise on its leading position in Nanotechnology, but would benefit from larger deal sizes in Space Technology.

Key findings

Recent Trends in SME Equity Finance

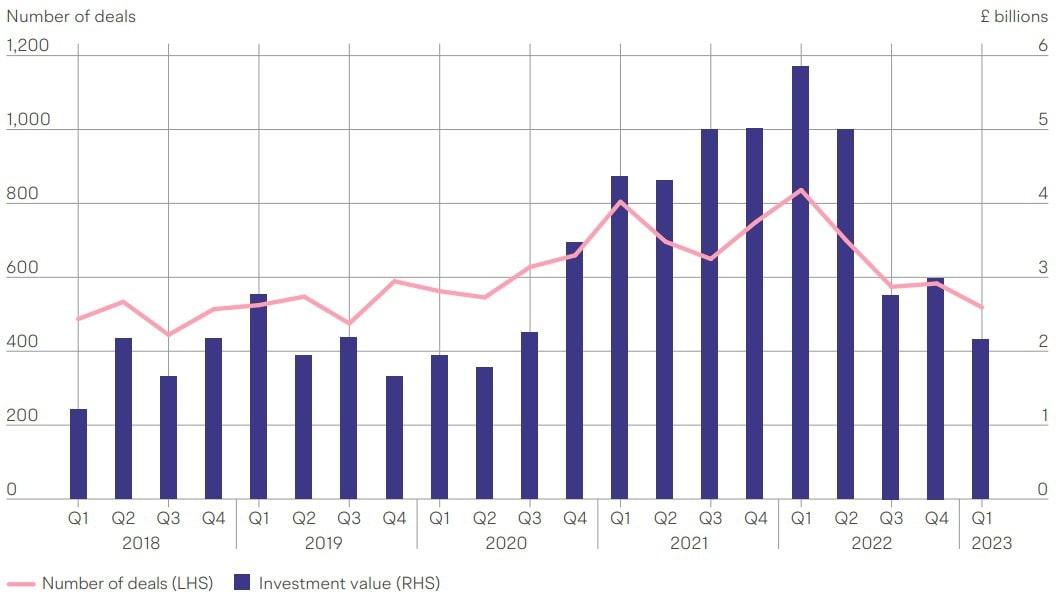

- After a strong year in 2021, the number of equity finance deals fell by 7% in 2022, with total investment also falling by 11% to £16.7bn.

- While a record level of investment was raised over the first two quarters in 2022, concerns about potential over-valuations and a more challenging exit environment, as well as rising inflation and interest rates, led to a 47% decline in total deal value during the second half of the year.

Number and value of equity deals by quarter

- Venture and growth stages experienced large declines in investment and valuations in the second half of 2022, though the seed stage was impacted to a lesser degree.

- Most UK nations and regions experienced fewer deals during 2022, except for Wales, Yorkshire & The Humber and the South West.

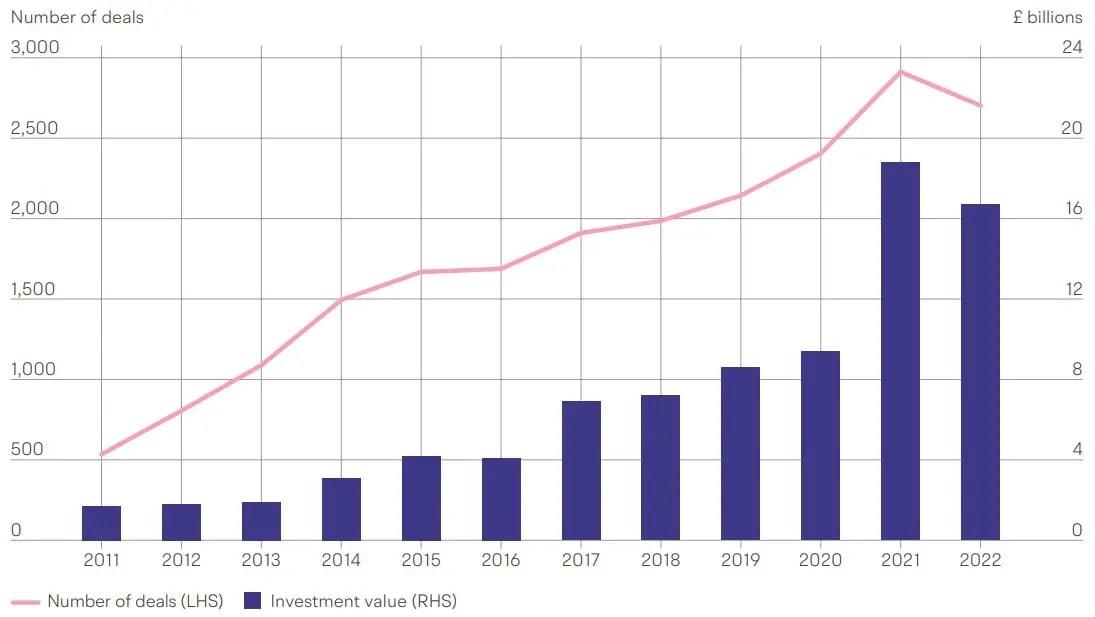

- University spinouts received 12% of total investment in 2022 with deals 33% larger than the average across the overall UK market, highlighting the importance of academic institutions in creating high growth innovative companies.

Number and value of university spinout deals over time

- The tech industry experienced an 11% drop in equity finance during the year, though cleantech bucked this trend with a 50% increase in funding.

- All female-founded companies received a record 9% of equity finance deals, but continue to receive a smaller share of total investment (2% in 2022).

British Business Bank Activity

Proportion of equity deals by stage in 2020-2022

- British Business Bank equity programmes supported around 13% of all equity deals between 2020 and 2022.

- British Business Bank supported funds were more likely to undertake deals in seed and venture stage companies compared to the overall market.

- Funds supported by the British Business Bank were more likely to invest into Technology/IP-based businesses than the overall equity market.

- Compared to the overall market, the Bank invested a higher proportion of its equity deals in eight of the twelve UK nations and regions.

- British Business Bank programmes are more likely to fund academic spinout companies than the overall equity market.

- An increasing proportion of Bank-supported deals are financing diverse founder teams.

UK Strengths and Opportunities in Breakthrough Technologies

- The UK has a track record in scaling technology sectors through its VC ecosystem, including FinTech, Software, Life Sciences & AI.

- Over £10.5bn in VC investment was raised by UK Life Sciences companies during 2020-22, more than Germany, France and Canada combined. Digital Health is a particular growth area for the UK, with VC funding increasing by over 150%.

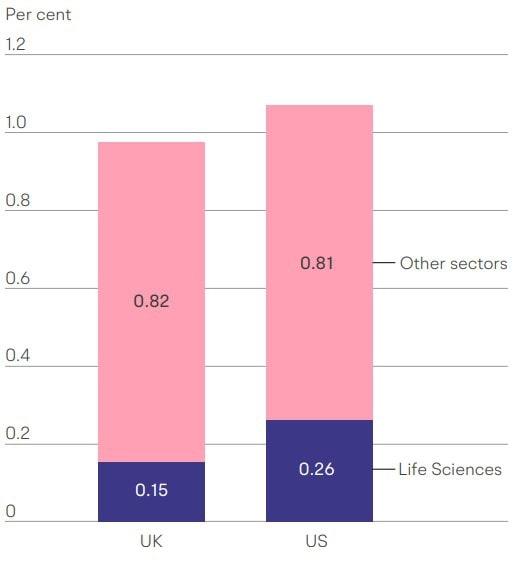

- The UK still underperforms in Life Sciences VC relative to its share of research capability, and on a GDP-adjusted basis only receives 60% of US VC.

- The UK can capitalise on its current position in Nanotechnology, as the third largest capital market in the world in this technology accounting for 13% of global VC between 2020-22.

- The UK has a foundation of research excellence, patent activity and over 100 start-ups upon which to scale future nanotech propositions.

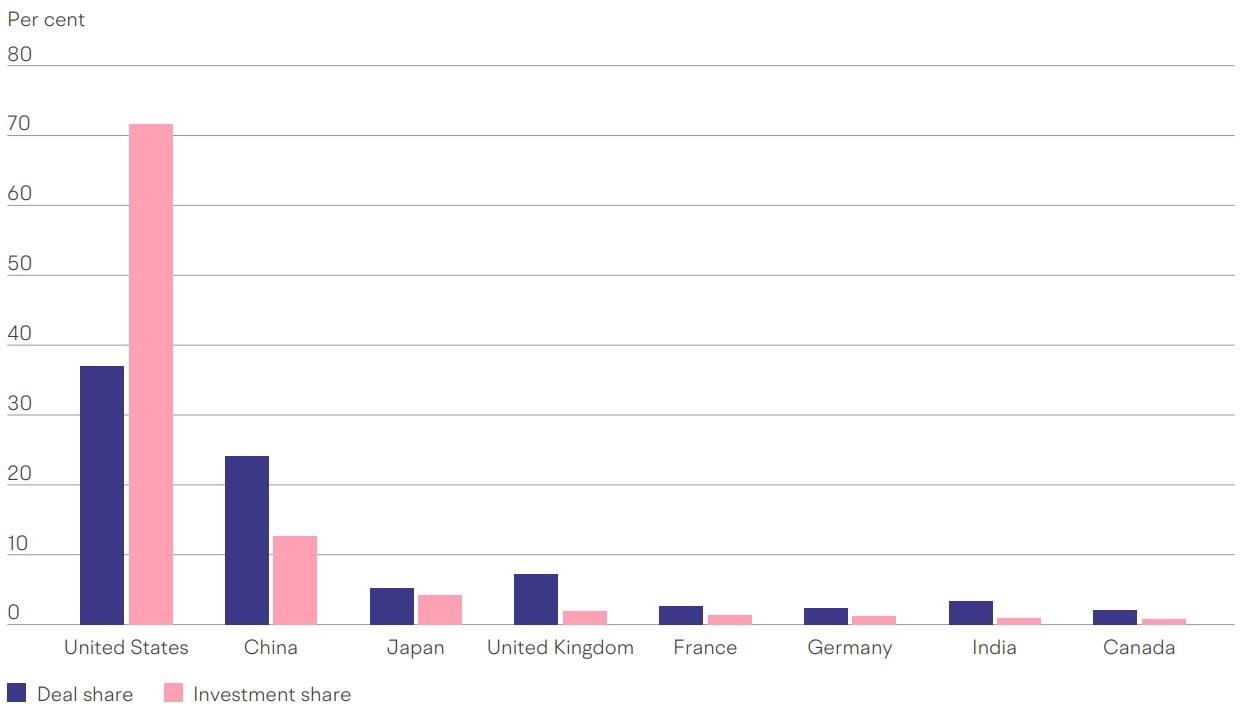

- There is also a significant future market opportunity in Space Technology, one of the fastest growing global technology areas.

- However, while the UK accounts for 7% of global Space Technology deals, it receives less than 2% of total investment value, indicating a need to attract larger round sizes to keep pace with international competitors.

UK and US VC investment in Life Sciences and other sectors, as a proportion of GDP (2020-2022)

Share of global VC investment in Space Technology by country (2022-22)

British Business Bank Response

The British Business Bank will use the evidence presented in this report to inform our ongoing discussions with Government, businesses, and the finance industry, and to refine our programmes, so they remain focused on parts of the market where smaller businesses can benefit most from the Bank’s support. This report highlights several important findings:

1. Downturn in SME equity finance and a reduction in the Bank’s market share.

The latter half of 2022 saw a significant decline in equity finance, particularly at later stages of the market. Through its range of equity finance programmes the Bank is committed to supporting business across all stages through these challenging market conditions, and to ensuring that the market has the breadth and depth to best recover from the current downturn. Looking ahead the Bank will continue to monitor UK equity finance conditions very carefully.

2. Continued concentration of equity deals in London.

London’s proportion of the UK’s equity deals increased by one percentage point to 50% in 2020-22. This shows the continued need for the Bank to address geographic disparities in equity finance. The report also shows that, compared to the wider market, the Bank allocates a greater proportion of its deals to areas such as the North West, Yorkshire & The Humber, the Midlands and the South West – highlighting the role of regional programmes such as the Northern Powerhouse Investment Fund, the Midlands Engine Investment Fund and the Cornwall and Isle of Scilly Fund within the Bank’s overall equity portfolio.

3. Consistent growth in investment in UK Cleantech companies.

In 2022 equity finance in the Cleantech sector rose by 50% to £0.9bn, marking its seventh consecutive year of increased investment. The Bank welcomes the continued growth of the industry given the scale of investment that is needed for the transition to a net zero economy. With our objective to support the UK’s transition to net zero, including via enabling SME-led green innovation, the Bank has an important role to play in continuing to unlock greater levels of equity finance for UK cleantech companies.

4. Key opportunities for the UK VC market in Life Sciences, Nanotechnology and Space Technology.

To ensure UK Life Sciences companies have the late stage and specialist capital they need to scale up, BPC’s Life Sciences Investment Programme (LSIP) will continue to make cornerstone commitments in later stage life sciences venture growth funds with a strong UK focus. In addition, the Future Fund: Breakthrough programme delivered by BPC is currently helping to fund later stage R&D intensive companies across a wider range of deeptech sectors.

Get in contact

If you would like to meet to discuss the British Business Bank’s work backing innovation and breaking down barriers to small business finance, please contact us below:

Public Affairs email us