What is the Small Business Finance Markets Report?

The British Business Bank’s annual Small Business Finance Markets Report is a comprehensive and impartial assessment of 2022/23 finance markets for smaller UK businesses.

This is a summary of key findings and conclusions from the 2023 report. The full report can be accessed here.

About the British Business Bank

The British Business Bank is the UK’s economic development bank. Our mission is to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by supporting access to finance for smaller businesses. The British Business Bank delivers a range of both debt and equity programmes, ensuring that small businesses can access finance that is right for their needs at the right time.

Small Business Finance Markets 2022/23

Snapshot summary

- Nominal gross lending to smaller businesses by UK banks was the second highest on record with challenger and specialist banks’ lending reaching a new high of £35.5bn in 2022.

- Equity finance remained exceptionally strong during the first half of 2022, reporting the best first quarter ever with a total of £7.5 bn invested into UK SMEs. However, market conditions in the second half of 2022 cooled.

- To deliver long-term economic growth the UK economy needs more highly innovative businesses generating cutting edge innovation and the greater adoption of innovative practices in the wider business population. Finance is a key enabler for success in both challenges.

- Small businesses have seen rapid growth in equity investment in green innovation with net zero deal numbers outpacing the wider equity market. However, delivering on net zero targets will still require significantly more equity and debt funded investment in small business.

- In the longer-term, finance can unlock sustainable growth, but female-led and Ethnic Minority-led businesses are often missing out. Despite being more open to using finance, Ethnic Minority-led and female-led businesses are more likely to be discouraged from using finance. Reasons for this include due to fear expectation of rejection, not knowing where to find appropriate finance and concerns over the length of the process and cost involved.

- As the UK’s economic development bank, the British Business Bank’s debt and equity finance programmes play an important role in the wider finance market, facilitating finance to innovative companies, breaking down barriers to finance across the UK, and enabling the transition to a net zero economy.

This year’s Small Business Finance Markets report is divided into two sections. Part A is dedicated to exploring the role finance has in supporting innovation and our transition to net zero. Part B examines developments in the macroeconomy, sustainable finance, and the smaller business population.

Key findings

What happened in 2022?

1. Lending from challenger banks and repayments hit record highs, despite fewer small businesses using external finance overall

- The total value of new bank lending to small businesses rose in 2022, in a year that saw the second highest value of bank lending on record.

- Banks lent a total of £65.1bn to SMEs in 2022, up 12.8% from 2021, below the record high of £105bn in 2020.

- Challenger and specialist banks lent a total of £35.5bn to SMEs– the highest amount on record.

- Overall demand for finance has fallen significantly despite the worsening economic situation. 33% of small businesses used external finance in Q3 2022, down from 44% in the same period 2021.

- Poor economic conditions led to increased demand for working capital finance as businesses struggled with higher input costs, lower revenue and increased late payments.

- SMEs repaid a total of £73.6bn in 2022 – the highest amount on record and 11.9% more than was repaid in 2021.

- Business investment is forecast to fall in 2023 which could potentially reduce smaller businesses’ demand for finance.

Gross bank lending to SMEs

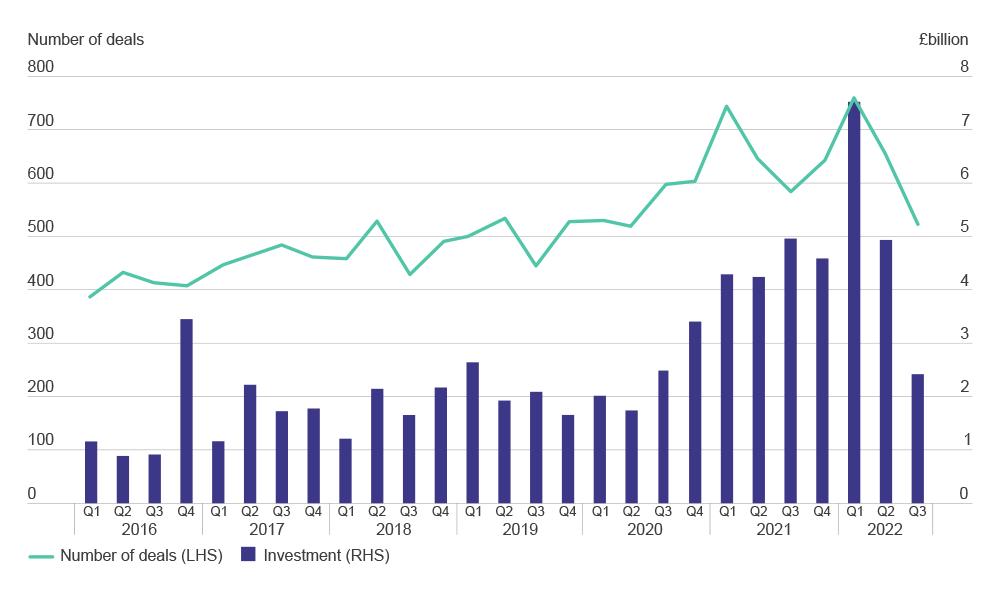

2. UK SME equity finance hit record highs at the start of the year, but venture and growth stage investment cooled off to more sustainable levels of investment in Q3

- The first quarter of 2022 was a record quarter for equity investment, with a total of £7.5bn invested into UK SMEs.

- Market conditions ‘cooled’ in Q3 2022 with declining investment and deal activity, representing a return to more sustainable levels of investment (in contrast to the exceptional levels of activity seen in the previous years).

- While venture and growth stage investment fell in Q3, seed stage investment increased by 23% compared to the first three quarters of 2021, with £1.5bn invested.

- Increased competition for deals has led to larger deal sizes and higher valuations over the last few years, but deal sizes and valuations dropped in Q3 2022 as investors revaluated their positions.

- UK mid-market private debt deals and investment increased substantially in 2021, but the market showed signs of a decline in 2022.

- Even so, London’s share of equity deals rose in 2022, receiving 52% of all UK equity deals during the first three quarters and accounting for 61% of total UK equity investment.

Number and value of equity deals

What matters for the long-term?

Proportion of innovative SMEs, OECD country comparison

3. Innovation is needed to unlock business performance and generate higher rates of productivity and growth

Economic growth requires innovation to flourish. However, a lack of finance can limit companies’ ability to develop and commercialise innovation. SMEs have reported that the Covid-19 pandemic had a detrimental effect on their ability to innovate and identified the availability and cost of finance as a barrier to innovation.

- UK SMEs lag behind other G7 nations in their adoption of innovations.

- Businesses are more likely to develop new products and improved processes if they use external finance compared to those that don’t. Overall, 65% of innovators used some form of external finance, compared to 58% of non-innovators.

- Businesses apply for a wide range of finance products to support the introduction of innovations with survey analysis suggesting small businesses are more likely to apply for grants, asset finance and overdrafts for innovation finance compared with other products.

- Availability and cost of finance are cited by SMEs as key barriers to developing and commercialising innovation.

- Barriers to finance could be preventing up to 270,000 SMEs from innovating every year.

Source: OECD, 2021 Innovation Indicators, collected from Eurostat Community Innovation Survey 2018 and National Innovation Survey

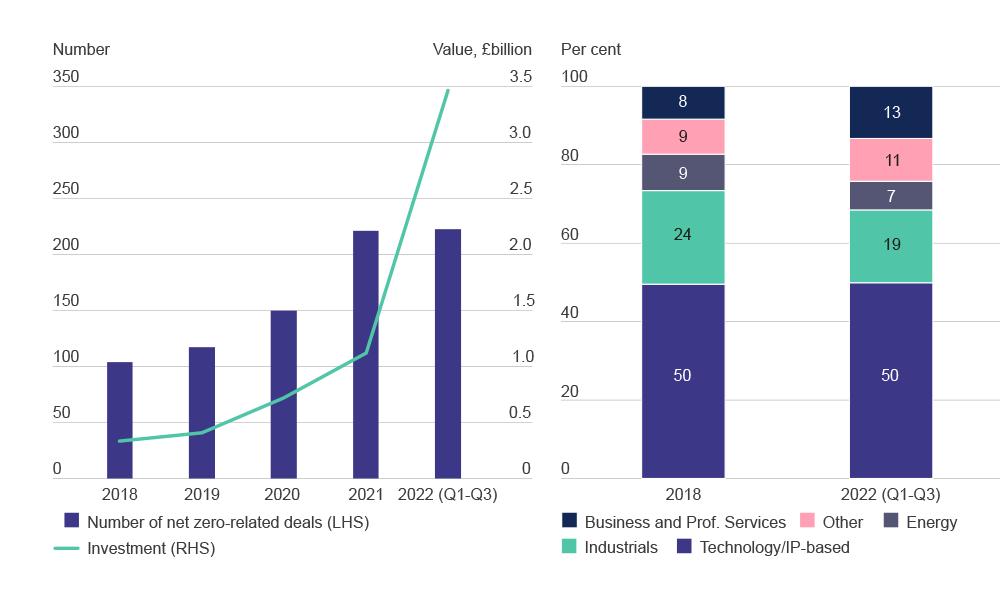

4. Growth in net zero-related equity deals is outpacing the wider equity market

Small businesses working on green innovations can play a significant role in driving the transition to net zero, and they have seen a welcome surge in equity investment in recent years. This suggests that equity finance markets are adapting to growing demand for investment in green innovation. Demand for external finance is relatively high among small businesses that prioritise environmental sustainability. These businesses are also more likely to expect turnover growth and anticipate a need for finance in the next 12 months. For the purposes of this research, “net zero-related deals” refers to deals in sectors including Clean Tech, smart energy, biomass and biofuels, artificial meat and meat substitutes, and EV and hybrid vehicles.

- Net zero-related deal numbers rose 33% in Q1-Q3 2022, outperforming the wider UK equity market.

- Net zero-related deals currently make up 12% of all announced SME equity deals, compared to just 5% in 2018.

- Investment value of net zero-related deals rose by 184% over the past year, soaring to a new record level of £1.7bn.

- Small businesses are active in innovation areas that can accelerate net zero transition, investing in Clean Tech solutions such as energy reduction technologies to improve energy efficiency, and clean energy generation, such as solar panels.

- Accessing suitable finance opportunities remains a challenge for smaller green innovators. Obtaining finance is an important barrier for around 1 in 5 SMEs who see offering solutions to environmental problems as important for their business.

Net zero-related SME equity deals: number and value over time, 2018-Q3 2022; % by top-level sector (based on number of deals)

5. In the longer-term, small business finance can unlock sustainable growth but female-led and Ethnic Minority-led businesses are missing out

- Ethnic Minority-led businesses are more likely than other businesses to consider applying for finance in 2023.

- However, expecting to be rejected and concerns over the cost of finance prevent some Ethnic Minority-led and female-led businesses from applying. 64% of Ethnic Minority-led businesses cited cost as a reason for not applying in 2021, an increase from 50% in 2020.

- Challenges faced by Ethnic Minority and female entrepreneurs in accessing finance have made it harder for them to invest in their businesses, with many needing to draw on personal funds.

- Ethnic Minority-led and female-led businesses were more likely than others to have taken steps to reduce their environmental impact and generate social benefits for people and communities. 55% of female-led businesses prioritise becoming more environmentally sustainable over the next 12 months, significantly higher than non-female led businesses (42%).

The role of the British Business Bank

6. In an environment of subdued economic activity, the British Business Bank is playing a crucial role providing small businesses with the finance they need to start and grow

- We are committed to driving sustainable growth and prosperity across the UK, and enabling the transition to a net zero economy, by improving access to finance for small businesses.

- As the UK’s economic development bank, the Bank’s debt and equity finance programmes play an important role in the wider finance market, facilitating finance to innovative companies so that they can develop new products and processes and improve their business capabilities.

- The Bank’s commercial subsidiary, British Patient Capital, provides equity finance to high potential UK companies through its equity programmes. Future Fund: Breakthrough and the Life Sciences Investment Programme aim to accelerate the deployment of breakthrough technologies which can transform major industries.

- The British Business Bank stands ready to support bank lending to smaller businesses through its existing programmes which are designed to bring benefits to businesses that are start-ups, businesses with high growth potential that are looking to scale up, and those businesses looking to stay ahead in their market.

- The Bank is integrating ESG factors throughout the investment lifecycle and across all our funding programmes. This will ensure that sustainability factors are considered in all our decision making and help us reach the UK’s diverse entrepreneurs so that all talented small business owners can access the finance they need, regardless of who and where they are. We are working with our delivery partners to break down barriers in access to finance and enable a just transition to net zero.

Get in contact

If you would like to meet to discuss the British Business Bank’s work backing innovation and breaking down barriers to small business finance, please contact us below:

Public Affairs email us