Report and publications

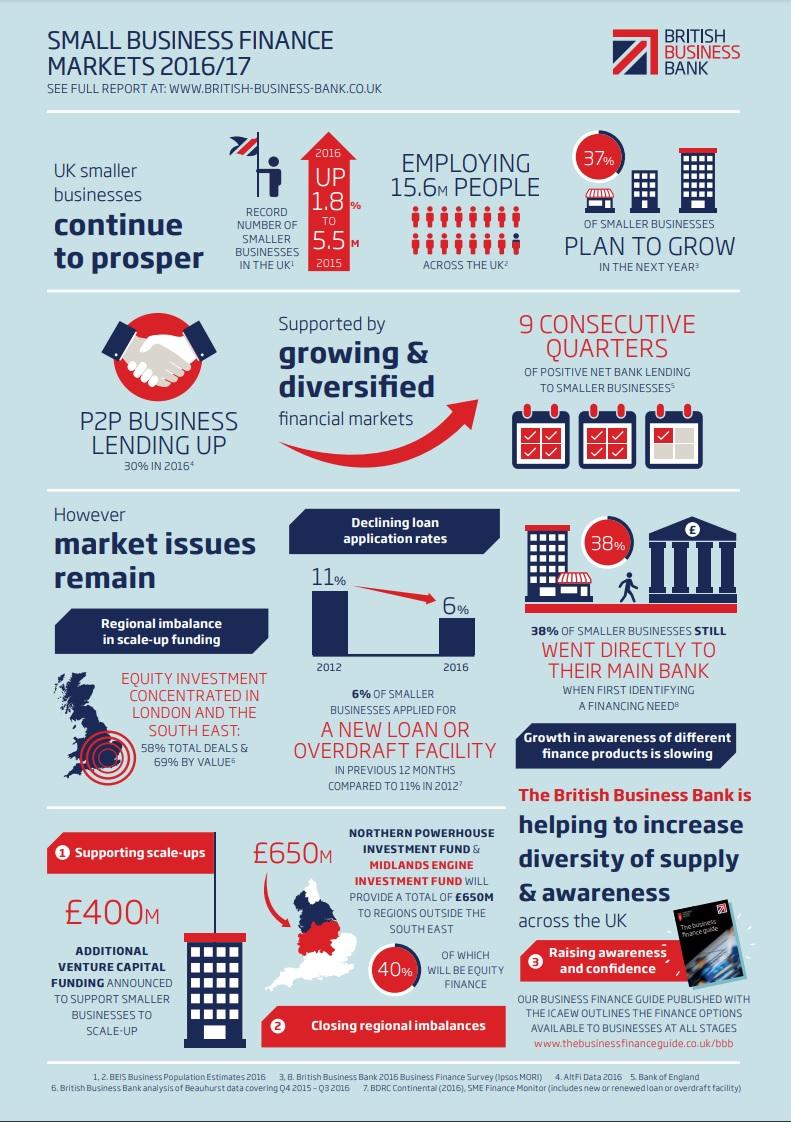

Our Small Business Finance Markets 2016/17 report shows that credit conditions for small businesses continue to improve, with a notable increase in the volume of asset finance and peer to peer business lending.

Economic uncertainty has, however, had an impact on small business confidence, with a drop in the number of smaller firms expecting to grow in the coming year. Many small businesses are wary about seeking external finance, reflected in a continued trend of falling application rates.

The report also finds that equity investment, which can be especially important for growing businesses, remains clustered in London and the South East.

Taking account of these market developments, the British Business Bank will continue to focus on three broad areas that we believe will support smaller businesses’ ambitions and raise the growth potential of the UK economy:

- Supporting scale-ups: Through helping small businesses with the potential to scale-up, and who are scaling up, to obtain the growth finance they need, and ensuring that they are aware of and understand the finance options available to them

- Closing regional imbalances: Making sure that finance reaches smaller businesses across all regions of the UK economy to deliver widespread growth

- Raising awareness: Supporting policy goals, such as those set out in the Competition and Markets Authority Retail Banking Market Investigation, by improving information in the market and links between smaller businesses and finance providers so that businesses get the finance that best meets their needs.

Additional Documents

The British Business Bank 2016 Business Finance Survey

This survey, undertaken by Ipsos MORI for the British Business Bank, follows on from the previous 2012, 2014 and 2015 “SME Journey” surveys to explore SME awareness of different types of external finance and their experience of raising finance. We have extensively used the findings from this survey within our new Small Business Finance Markets 2016/17 report to assess how finance markets have changed.

Amongst the findings, awareness of different finance products continues to improve, albeit at a slowing pace, but awareness of specific providers is lacking behind. The survey also revealed that awareness of equity finance remains greater for small businesses in London compared to other English regions.

The survey, conducted in November 2016, also provides a snapshot of SME response to the EU Referendum result. The majority of SMEs surveyed have not made any changes as a result of the referendum, however a small proportion report an intention to change investment plans over the next 12 months.

Small Business Finance Markets 2016/17

Our Small Business Finance Markets 2016/17 report shows that credit conditions for small businesses continue to improve, with a notable increase in the volume of asset finance and peer to peer business lending.