Report and publications

Our Small Business Equity Tracker 2022 Report (PDF, 1.79 MB) provides a comprehensive picture of equity funding conditions for smaller businesses across the UK. It is intended not only to inform the development of the Bank’s own strategy, but also to inform wider developments in both the market and government policy.

This year, the eighth edition of the report, consists of four sections covering:

- Recent trends in SME equity finance, summarizing deal and investment activity in 2021 and Q1 2022.

- British Business Bank activity, exploring the characteristics of equity deals completed by equity funds supported by the British Business Bank.

- UK VC market compared to other countries, comparing the size and structure of the UK VC market against several comparator countries.

- The contribution of overseas investors into the UK VC ecosystem, exploring the role of overseas investors in the UK equity ecosystem.

Key findings:

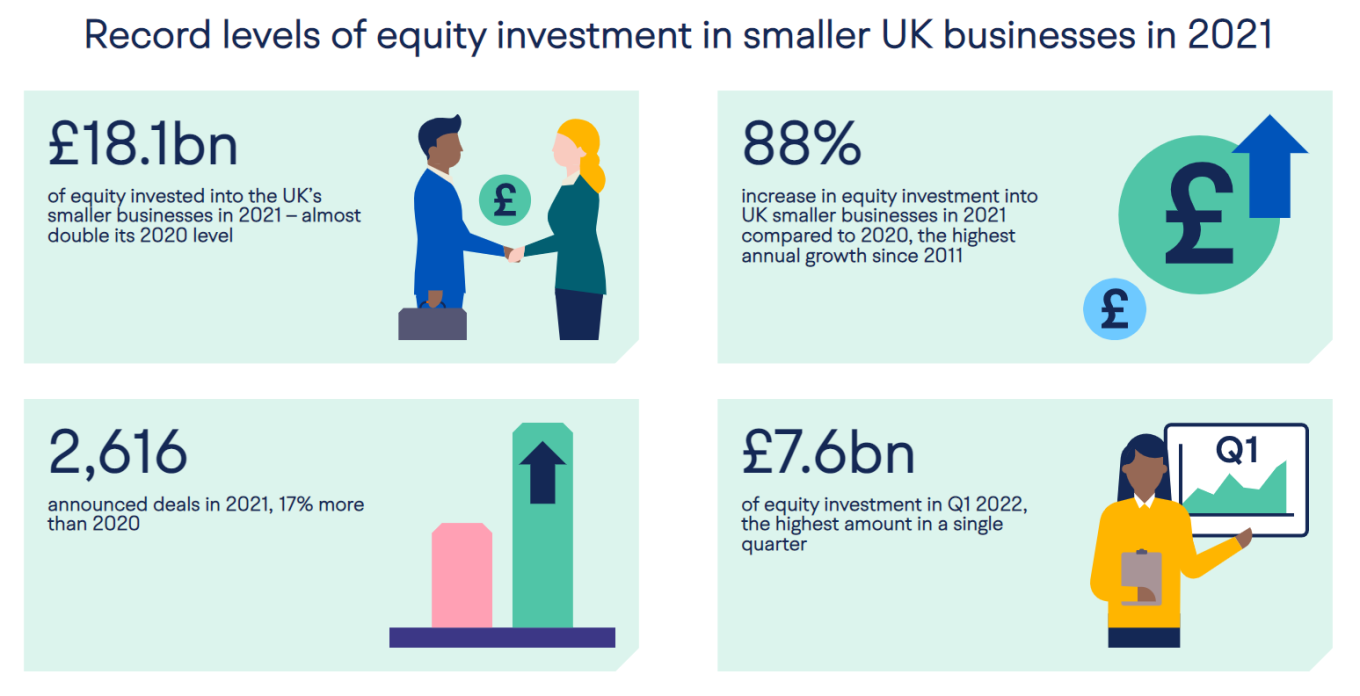

- Equity investment in the UK’s smaller businesses increased by 88% in 2021 to £18.1bn compared to the previous year, the highest yearly amount since the Beauhurst data series began in 2011.

- The strong momentum continued into Q1 2022, with £7.6bn of equity investment reaching smaller businesses, the highest amount invested in a single quarter at nearly double that of the £4.3bn in Q1 2021.

- Investment in UK tech companies has continued to grow rapidly in the past five years, rising to £8.2bn in 2021, up from £4.1bn the previous year. Investment into the UK’s tech-based companies is crucial for building the future economy and strengthening its position as a tech hub in Europe.

- Within technology subsectors, investment into smaller businesses in the life sciences sector rose from £800m in 2020 to £1.7bn in 2021 and software deals more than doubled from £2.3bn in 2020 to £4.8bn in 2021, in line with wider equity market trends. The Bank’s analysis also showed a 30% increase in the number of clean tech deals with £436m invested into this sector across 72 deals.

- The UK retains its position in 2021 as the largest venture capital (VC) market in Europe, larger than France and Germany combined. However, despite the UK being the European leader in the VC market by investment, it still lags behind the US.

- In 2021, 753 deals involved an overseas investor, 58% higher than in the previous year and equating to 29% of all deals recorded. Overseas investors were involved in equity deals to the value of £13.5bn, which is equivalent to 75% of the total £18.1bn invested during the period.

- The Bank supported around 18% of all announced UK equity deals in 2021, with funds supported by the Bank more likely to invest in technology and IP-based businesses compared to the overall equity market. Between 2019-21, 47% of the Bank’s supported deals were in this sector compared to 39% of the overall market. The Bank also has a higher proportion of equity deals outside of London (53%) than the wider PE/VC market (48%).

Small Business Equity Tracker 2022 Download

Our Small Business Equity Tracker 2022 Report provides a comprehensive picture of equity funding conditions for smaller businesses across the UK.