Report and publications

Our Small Business Finance Markets 2020/21 report (.pdf - 8.85MB) provides a timely and comprehensive review of finance markets for smaller businesses.

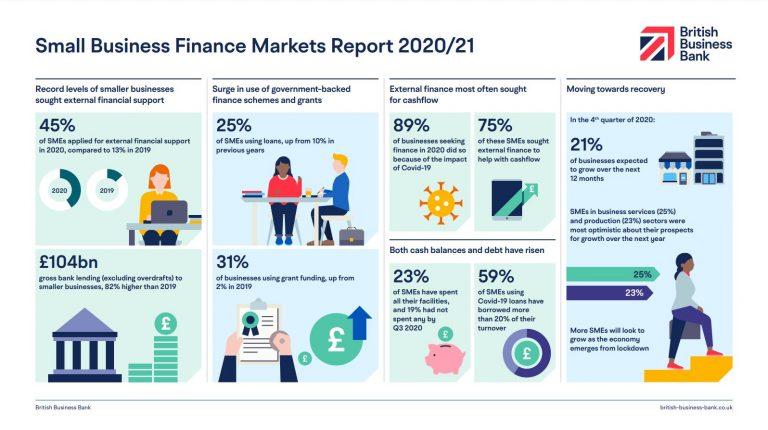

This year, the report focuses on the impact of Covid-19 on small business finance markets and the implications for 2021, and the use of finance by smaller businesses and market developments in finance products.

Four themes provide the background to the seventh edition of the Small Business Finance Markets report:

- First, businesses shifted away from most traditional forms of external finance to utilise government-backed finance schemes and support. The utilisation of bank overdrafts, credit cards and asset finance all fell, while the only increase in the usage of traditional repayable external finance was seen in loans.

- Second, smaller businesses have faced a lot of uncertainty in 2020 – with the smallest businesses hardest hit. A large proportion of businesses have been forced to seek finance due to the impact of Covid-19, most often to help with cashflow.

- Third, as businesses continue to recover from the effects of the pandemic, there could be significant further demand for funding in 2021.

- Fourth, the report finds that, due to record cash balances and increasing debt levels, there are both a sizeable number of smaller businesses in a position to borrow further in 2021 and a sizeable number likely to struggle with debt repayments.

The British Business Bank 2020 Business Finance survey

Evidence from our annual survey, based on over 4,000 interviews undertaken by Ipsos MORI between August and November 2020 for the British Business Bank, is used extensively in the Small Business Finance Markets Report. This year we’ve adapted the survey to capture the impact of Covid-19 on small business finance markets. Questions explore issues such as the rapid change in the types of external finance used by SMEs, the ways in which smaller businesses have used this finance to help their business survive and recover and their expectations for 2021.

We’ve also run the survey with additional SMEs that have applied for the Bounce Back Loans and also to cover mid-sized businesses. Separate slide decks covering these types of business are published alongside the main SME survey.

Small Business Finance Markets Report 2020/21

Our Small Business Finance Markets 2020/21 report provides a timely and comprehensive review of finance markets for smaller businesses.