Report and publications

Our Regions and Nations Tracker (.pdf - 7.72mb) explores the geographic patterns seen in UK smaller business finance. This first annual tracker is designed to complement our flagship Small Business Finance Markets report with additional regional analysis.

The five main components of the report are:

- Section 1.1 which provides an overview of finance markets in the regions and nations of the UK that explains which forms of finance are most commonly used across the UK and delves into some of the geographic imbalances in usage we see.

- Section 1.2 which sets out detailed analysis of equity investor networks that sheds light on the importance of distance between investors and investee companies.

- Section 1.3 which covers finance use in rural firms and how this differs to usage among firms in urban locations.

- Section 1.4 which explains how the Bank’s programmes support businesses across the UK.

- Part B sets out datapoints for each region and nation in the UK.

Key Findings

-

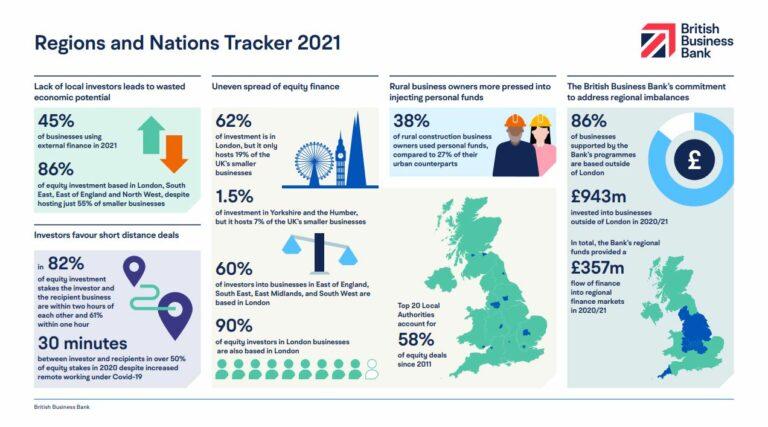

External finance is an important tool for businesses, but it is not evenly spread across the UK

The largest four regions within the UK, London, the South East, the East of England and the North West, host 55% of the business population but take in 86% of equity investment. These areas also outperform on private debt, attracting 69% of investment.

-

Gaps in finance lead to wasted economic potential, so we need to understand the geographic factors behind them

Although London, the South East, the East of England and the North West outperform the rest of the UK in attracting important forms of growth finance, their share of high growth businesses is unremarkable. 55% of high growth businesses were in these four regions between 2018 and 2019, a share that exactly matches the proportion of the general business population to be found.

-

Distance matters, even in a business world that has embraced remote working

In 82% of equity investment stakes, the investor has an office within two hours travel time of the company they are backing. In 61% of instances, the proximity is even closer and the two parties can travel between their premises in one hour or less. Increased remote working in 2020 does not appear to have affected these distance patterns in equity investment.

-

Rurality matters too, with rural businesses seemingly more pressed into injecting personal funds

39% of rural firms were currently using a form of external finance in 2020 compared to just 36% of urban businesses. Despite higher external finance use, a greater share of rural business also injected personal funds in 2020. 37% of rural-based business owners had injected personal funds into their business in the last 12 months compared to 32% of their urban counterparts.

The Regions and Nations Tracker 2021 Report

Our Regions and Nations Tracker explores the geographic patterns seen in UK smaller business finance.