City-based clusters lead equity investment market, according to latest research from the British Business Bank

Press release

City-based clusters and tech hotspots were the focus of equity investment in the UK last year, according to the third annual Equity Tracker, published today by the British Business Bank.

The Small Business Equity Tracker provides an in-depth assessment of equity markets for growing businesses, delivered in partnership with data specialist Beauhurst.

The findings show that, following five years of growth, equity deals to smaller businesses in the UK fell last year across all sectors, by 18% in terms of the number of deals and 4% in value. This was in line with a wider global slowdown in equity finance in 2016. However, the latest research from Beauhurst shows a record £3.03bn of equity invested in the first half of 2017 up by 74.7% on the previous 6 months.

Today’s Equity Tracker outlines emerging clusters of strong deal activity around the country. Technology sectors bucked the market trend as the amount invested rose to £1.7bn – the highest level on record meaning technology represented almost half (49%) by value of the total equity market.

London continued to experience greater levels of equity investment compared to other UK regions, with £1.9bn in funding in 2016. However, the capital experienced a decrease in its share of UK deals (47%, down from 50% in 2015); a 22% decline in the total number of deals; and a drop in total investment value of 1%.

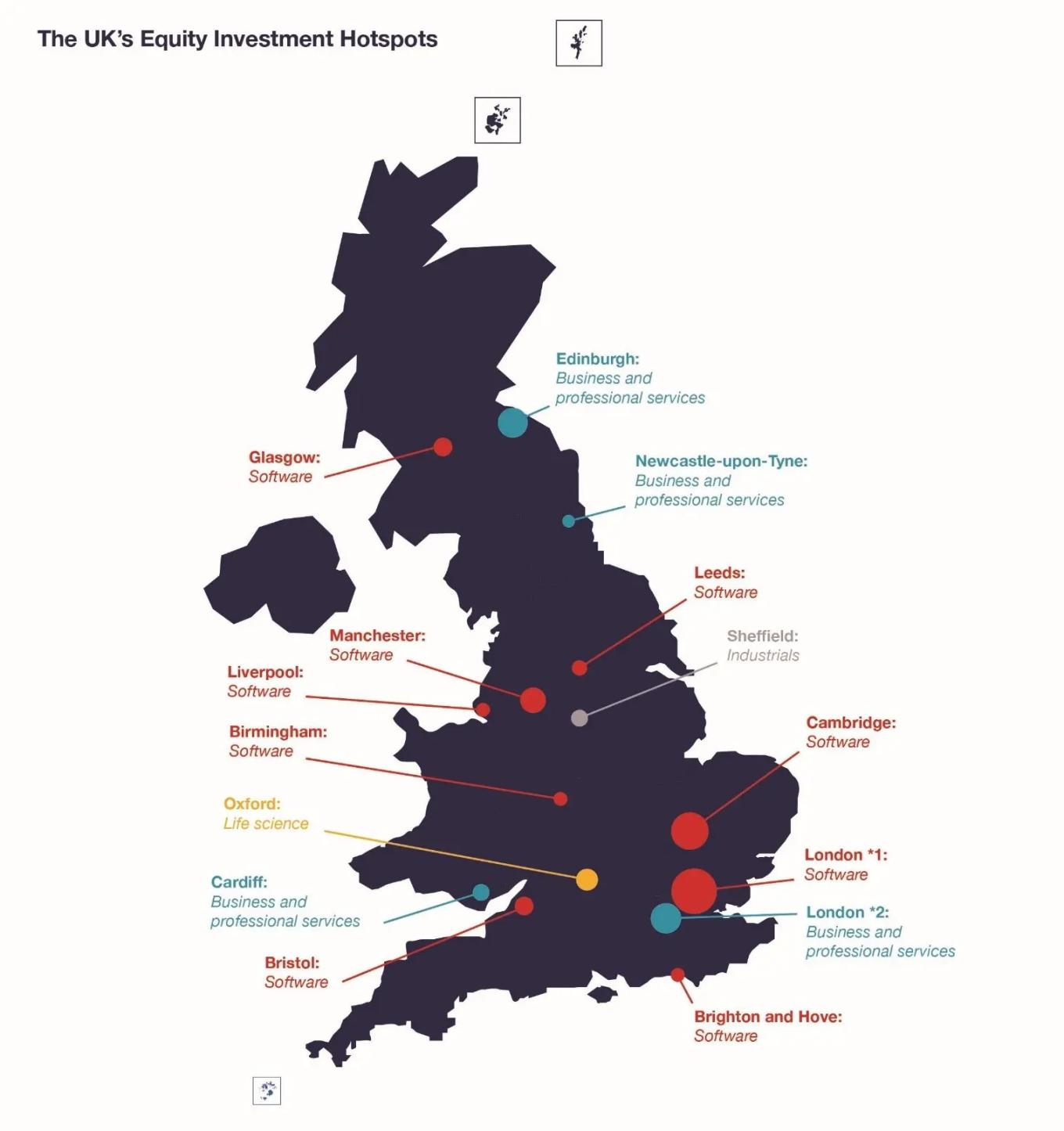

Elsewhere, trends in equity deals varied geographically, with successful equity clusters in many UK cities, including Edinburgh, Manchester, Bristol and Birmingham, and the already-established equity eco-systems of Oxford and Cambridge. These clusters often have a combination of innovative companies, skilled staff and equity investors, creating dynamic hubs of growth and propelling equity investment.

This research provides the most accurate and complete view of the state of the SME equity finance market in the UK for growing businesses. While the market here followed the global downward trend in equity investment, there are positive signs of innovative growing businesses receiving significant investment in clusters across the UK. Regional disparities continue, however, and that’s something we’re working hard to address. We launched our £400m Northern Powerhouse Investment Fund earlier this year, and this is already providing funding to fund managers who are investing in local businesses. We will be introducing similar initiatives for the Midlands and Cornwall and the Isles of Scilly over the coming months. - Keith Morgan CEO, British Business Bank

Top 25 Local Authority areas for equity investment deals in 2016:

| Rank | Local Authority District | Sector with highest number of deals |

|---|---|---|

| 1 | Hackney London Borough Council | Software |

| 2 | Camden London Borough Council | Software |

| 3 | Westminster City Council | Software |

| 4 | City of London | Software |

| 5 | Tower Hamlets London Borough Council | Business and professional services |

| 6 | Cambridge City Council | Software |

| 7 | Islington London Borough Council | Software |

| 8 | Lambeth London Borough Council | Software |

| 9 | Edinburgh City Council | Business and professional services |

| 10= | Southwark London Borough Council | Business and professional services |

| 10= | Manchester City Council | Software |

| 12 | Oxford City Council | Life science |

| 13 | Hammersmith and Fulham London Borough Council | Software |

| 14 | Wandsworth Borough Council | Business and professional services |

| 15= | Kensington and Chelsea Royal Borough Council | Business and professional services |

| 15= | Bristol City Council | Software |

| 17 | Glasgow City Council | Software |

| 18= | Cardiff Council | Business and professional services |

| 18= | Newcastle upon Tyne City Council | Business and professional services |

| 20 | Sheffield City Council | Industrials |

| 21= | Barnet London Borough Council | Software |

| 21= | Leeds City Council | Software |

| 21= | Birmingham City Council | Software |

| 21= | Brighton and Hove City Council | Software |

| 25 | Liverpool City Council | Software |

Further Information

Notes to editors

About the British Business Bank

The British Business Bank is the UK’s national economic development bank. Established in November 2014, its mission is to make finance markets for smaller businesses work more effectively, enabling those businesses to prosper, grow and build UK economic activity. Our remit is to design, deliver and efficiently manage UK-wide smaller business access to finance programmes for the UK government.

The British Business Bank is currently supporting over 59,000 businesses, working through over 100 finance partners. Its programmes support over £3.4bn of finance to UK smaller businesses and participate in a further £5.8bn of finance to UK small mid-cap businesses.

As well as increasing both supply and diversity of finance for UK smaller businesses through its programmes, the Bank works to raise awareness of the finance options available to smaller businesses.

British Business Bank plc is a limited company registered in England and Wales, registration number 08616013, registered office at Foundry House, 3 Millsands, Sheffield, S3 8NH.

As the holding company of the group operating under the trading name of British Business Bank, it is a development bank wholly owned by HM Government which is not authorised or regulated by the Prudential Regulation Authority (PRA) or the Financial Conduct Authority (FCA). The British Business Bank operates under its own brand name through a number of subsidiaries, one of which is authorised and regulated by the FCA.

British Business Bank plc and its principal operating subsidiaries are not banking institutions and do not operate as such. A complete legal structure chart for British Business Bank plc and its subsidiaries can be found on the British Business Bank plc website.

About Beauhurst

Beauhurst provides research and insight on the UK’s high-growth companies.

Thousands of business professionals trust their platform (beauhurst.com), to help them research and monitor Britain’s most ambitious businesses.

Since Beauhurst’s founding in 2011, they have provided research on almost 25,000 companies, and analysed over £35bn of investment from over 2,500 funders.

Their publications are trusted to provide an accurate picture of ambitious companies and their flagship report, The Deal, is widely read and cited in the business community. They work closely with some of the UK’s most respected institutions to help them understand the high-growth economy.

For more information, visit their website beauhurst.com.

Latest news

-

Read more about Future Fund was critical for business survival finds independent assessment Press release

09 September 2025 -

Read more about West Midlands-based Coventry and Warwickshire Reinvestment Trust announced as the third accredited delivery partner under the British Business Bank’s Community ENABLE Funding programme Press release

08 September 2025 -

Read more about British Business Bank announces £8 million investment into NRG Therapeutics Press release

08 September 2025