In response to the COVID-19 outbreak, Acorn Early Years Foundation had to close a number of its nurseries, with attendance falling to around 10% of its usual level. With very little income, it couldn’t see a way to survive the pandemic without a cash injection via the Coronavirus Business Interruption Loan Scheme (CBILS).

Case study

| Region/Nation | South East |

|---|---|

| Programme | Coronavirus Business Interruption Loan Scheme (CBILS) |

| Partner |

Read what the business had to say in this CBILS case study.

British Business Bank: Can you tell us what your organisation does?

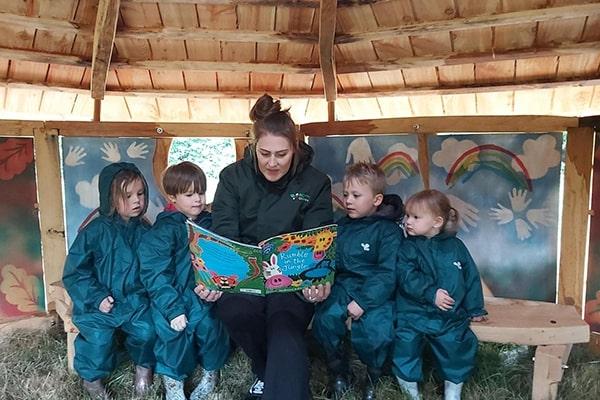

Zoe Raven, CEO of Acorn Early Years Foundation: We run day nurseries, out-of-school clubs, playschemes, and training for the early-years sector. We use a cross-subsidy model to provide affordable, high-quality early-years care and education for low-income families and vulnerable children.

We operate in Milton Keynes, Northamptonshire and Bedfordshire, and are due to open a new nursery in central Milton Keynes in July, which has been funded by social investment from CAF Venturesome.

The coronavirus has affected a huge number of businesses across the UK. What problems were you facing as a result of the outbreak and what made you apply for CBILS support?

In response to the COVID-19 outbreak, all our nurseries had to close apart from those caring for key workers’ children and vulnerable children. We never envisaged a situation where the nurseries would have to close for a reason not covered by insurance. Although we kept six of the 12 nurseries open, attendance was down to about 10% of its usual level.

From the end of March through to the end of June, we had very, very little income and couldn’t really see how we were going to manage that with our cashflow. We had no working capital to survive the crisis. Although we were able to use the furlough scheme, it didn’t cover anything towards the overheads of buildings and other operational costs. We knew that we would need a cash injection to see us through this difficult time.

How long did the application process take? Did you need any support?

From application to approval, it took 12 days. We were particularly happy with the speed of decision-making because we were given a very clear indication of when the panel would meet to decide and how soon we would be informed about it. This was in line with our expectations and it was very clear so we weren’t left in limbo for too long.

The application process was straightforward, but it was also very thorough. It included detailed conversations over the phones around eligibility, cashflow forecasts and social impact (something that you wouldn’t normally go through with a bank). It was interesting to delve into what we’re trying to do, how we’re trying to do it, and why our services are needed – supporting not just vulnerable children, but also working families.

The team and I didn’t need a lot of support in the application as we had a lot of financial and management information easily accessible. This made it very easy to find the information and send it over quickly.

Without the scheme, we would’ve had to make more staff redundant. We’ll now be able to survive with very few, if any, redundancies, meaning we can preserve our workforce and the future of the nurseries. - Zoe Raven CEO of Acorn Early Years Foundation

What advice would you give to other businesses that are applying for a CBILS loan?

We found it a very positive experience and we’re really pleased that we’ve done it, but it does depend on the individual circumstances of the organisation.

If the organisation doesn’t have a future, then borrowing isn’t always the best route out of the problem. It was for us and I’d certainly encourage anybody that’s looking for a loan to go down this route because the advantages of no interest for a year and no arrangement fees as part of CBILS is extremely beneficial.

How has the CBILS loan helped your organisation to weather the outbreak? And what might have happened if you hadn’t received it?

The loan has helped us survive the outbreak because it’s given us working capital and enabled us to survive the cashflow requirements of salaries and rents for the business for six months. We’re very confident now that by the end of the period of the loan, which we have for a year, we’ll be able to repay it.

Without the scheme, we would’ve had to make more staff redundant. We’ll now be able to survive with very few, if any, redundancies, meaning we can preserve our workforce and the future of the nurseries.

And we can look forward with confidence that we’ll survive the crisis. Some of our nurseries are more financially sustainable than others, and the heart-breaking thing is that the nurseries that are situated in the most disadvantaged areas, serving the children who are most in need for early-years care and education, would’ve been the ones that we wouldn’t have been able to save. Therefore, the CBILS loan has made a huge difference not just to us as an organisation, but all the families and communities that we serve.