The British Business Bank is the UK's economic development bank. Our mission is to drive sustainable growth and prosperity across the UK, and to enable the transition to a net zero economy, by supporting access to finance for smaller businesses. We deliver a wide range of finance programmes, each designed to address a market gap and support smaller businesses’ access to both debt and equity finance.

Backing innovation is a strategic objective for the Bank, ensuring innovative businesses can access the right capital to start and scale. We form an important part of the innovation funding landscape through our equity programmes, which invest in high-growth, innovative UK businesses, and in supporting UK debt markets, which help firms to innovate both their products and processes. Boosting business innovation is essential to the UK’s future prosperity, and key to the delivery of new jobs, better living standards and long-term economic growth.

The Bank supports university spinouts across a range of our programmes, both debt and equity. By backing innovation led businesses, including university spinouts from the UK’s universities and research institutes, we will help lead the way in turning UK innovation ambition into reality.

To achieve this, we are:

- Supporting university spinouts to start and scale in the UK. The Bank’s programmes are more likely to fund academic spinouts than the wider equity market Read footnote text 1 .

- Investing in funds that back university spinouts across the UK, such as a £30 million British Patient Capital investment in Northern Gritstone.

- Working with partners, such as UK Research and Innovation and Innovate UK to ensure spinouts can access the full benefits of the pipeline of early-stage funding.

-

Return to footnote location

1

British Business Bank, Small Business Equity Tracker (June 2023)

Why are university spinouts important?

The creation of spinout companies is an important avenue through which founders and universities can commercialise cutting edge academic research. Beauhurst define an academic spinout as a company that was set up to exploit IP developed by a recognised UK university and then either licences the IP from the university, or the university owns or has the option to purchase shares in the company. It is important to note that staff or students can set up start-ups which would not meet this definition.

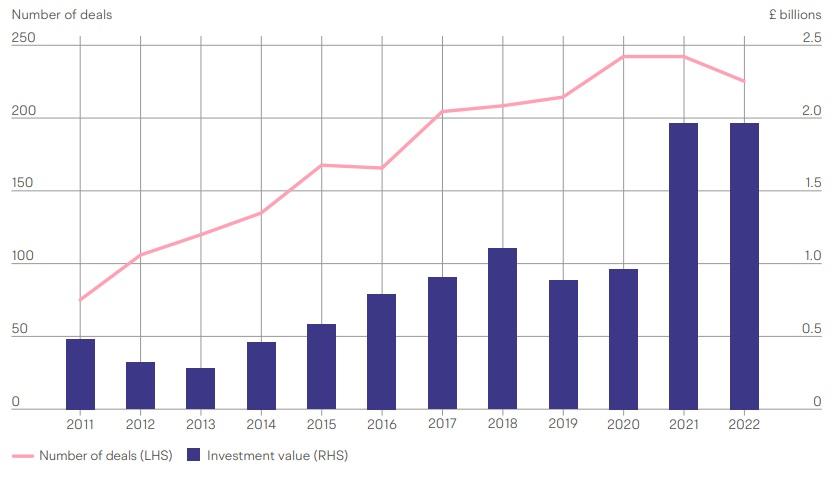

The British Business Bank's 'Small Business Equity Tracker' outlines how the value of equity deals involving university spinouts has increased in the UK:

97%

of spinouts, that went on to receive funding from the BBB and IUK remain active, compared to 49% of those who did not.

£2bn

was invested in spinouts during 2022, a record annual total

33%

University spinouts raised 33% larger deal sizes (on average) than the wider market

Number and value of university spinout deals over time

What is the British Business Bank doing?

130

equity investments made to university spinout companies by British Business Bank supported funds, between 2020-22

12%

of deals by Bank backed funds supported university spinouts, higher than the wider PE/VC market (6%) and the overall equity market (9%)

16%

of Bank's deals into university spinouts were made by the Northern Powerhouse Investment Fund (NPIF) and the Midlands Engine Investment Fund (MEIF)

The British Business Bank has a number of programme that support university spinouts. British Patient Capital, the Regional Angels Programme and Managed Funds were the largest contributors, together making up 71% of the Bank's equity deals into university spinouts, between 2020-22.

British Business Bank (BBB), UK Research and Innovation (UKRI) and Innovate UK (IUK)

‘Backing innovation-led businesses: the role of public investment’ report, published by the British Business Bank and UK Research and Innovation, including Innovate UK found that university spinouts that receive funding from both the Bank and IUK are more likely to have better business and employment outcomes.

The research (published in February 2022), focused on a cohort of "research council spinouts" founded between 2010 and 2014, found that:

97%

of spinouts, that went on to receive funding from the BBB and IUK remain active, compared to 49% of those who did not.

91%

of spinouts with funding from BBB and IUK report having employees, compared to only 43% of spinouts not funded by either.

4.6

external equity rounds on average, for BBB and IUK backed spinouts compared to 2.9 for those who had not.

£7.3m

median value of equity investment raised in the first eight years, compared to £1.6m for those without funding from BBB and IUK.

Geographic Trends

The 'Backing innovation-led businesses: the role of public investment' report also found that equity-backed spinouts are found across the UK, but those in the 'Golden Triangle' of London, Oxford and Cambridge secure the most investment. University and research institution spinouts are considered less London-centric compared to the wider UK venture capital market, but a lack of access to established finance ecosystems may be hindering investment outside the Golden Triangle.

- Only 17% of spinout companies came from London, with a further 30% from the South East and East of England.

- Spinouts outside the Golden Triangle were less likely to access equity capital, with 40% raising at least one round of external equity, compared to 53% of those within the Golden Triangle.

- The value of capital raised differed even more substantially, with the median spinout in the Golden Triangle, having raised £5.7 million by year eight, compared to £1.4 million for the median spinout in the rest of the UK.

The Bank’s programmes are dedicated to helping smaller businesses wherever they are in the UK accessing the finance that is right for them. 16% of deals made by the Regional Angel’s Programme run by British Business Investment (BBI), one of the Bank’s commercial subsidiaries, went to university spinout companies. Whilst the Bank’s regional funds also made important contributions, with 27% of MEIF and 15% of NPIF equity deals supporting university spinout companies.

Northern Gritstone

In March 2023, British Patient Capital made a £30 million investment into Northern Gritstone Limited, the investment company focused on university spinouts and R&D-intensive businesses across the North of England.

With a focus on spinouts from their partners at the universities of Leeds, Manchester and Sheffield, alongside other local science and technology start-ups, Northern Gritstone supports the commercialisation of the world-class research and innovation originating from these institutions. It aims to catalyse the nascent venture ecosystems around these communities, drawing in further external capital to drive their growth. While Northern Gritstone will typically invest at pre-seed and seed stage, as a long term investor, it has the capability to invest throughout the lifecycle, and into more established businesses at the later stage.

British Business Bank Backed Spinouts

EarthSense

EarthSense is an air quality monitoring and modelling data firm that emerged from the University of Leicester in 2016. The University of Leicester has a strong heritage in Earth Observation Science, underpinned by long-term funding from the Natural Environment Research Council. Earthsense uses data from ground sensors and satellites to produce unique, high resolution maps of air pollution from country-scale right down to street corners. In 2019 the Midlands Engine Investment Fund (MEIF), managed by Maven Capital Partners, provided EarthSense with a £200,000 of debt finance for growth. The funding enabled the business to invest further in research and development while also creating new jobs in the East Midlands.

Liopa

Liopa is a spinout from the Centre for Secure Information Technologies at Queen’s University Belfast. Initially developed by two Engineering and Physical Science Research Council funded (EPSRC) PhD students, Liopa’s core product, known as LipRead, is an accurate and easy-to-use visual speech recognition platform focused on the speech recognition market. Between 2019 and 2021, Liopa received two Innovate UK grants to help develop a lip-reading aid to help enable communication with tracheostomised patients, especially important during the Covid-19 pandemic where a large number of ventilated patients required a tracheostomy. In 2020 Liopa was in the process of raising finance to release products to the digital healthcare and media transcription markets when the pandemic broke out. At that time, the amount of available venture capital investment fell drastically, which threatened to severely hamper go-to-market plans. Struggling to raise funding, it secured investment from the Future Fund, which allowed the company to maintain its business plan. In 2021, Liopa secured its first commercial contract with a UK-based hospital.

Get in contact

If you would like to meet to discuss the British Business Bank’s work backing innovation and breaking down barriers to small business finance, please contact us below:

Public Affairs email us