Report and publications

The UK Venture Capital Financial Returns 2020 report provides a comprehensive assessment of the performance of UK VC funds since 2002, and an overview of the current VC market, in light of Covid-19. The report draws together data from existing data sources including PitchBook and Preqin, and from the Bank’s own programmes, as well as a new survey of fund managers.

Key findings

- UK VC funds with 2002-2007 vintage delivered good financial performance, with a pooled DPI of 1.61 and TVPI of 1.99.

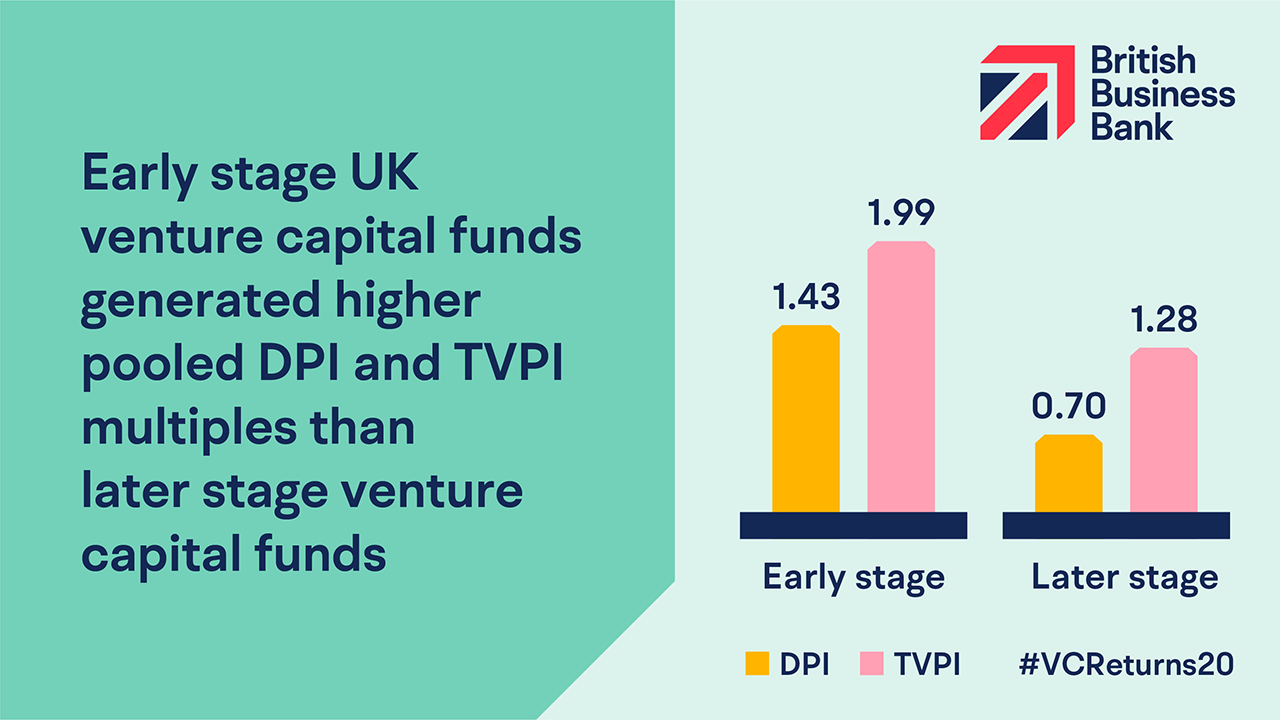

- Early stage VC funds with a 2002-2015 vintage year generated higher pooled DPI (1.43) and TVPI (1.99) multiples than later stage VC funds (DPI 0.70, TVPI 1.28)

- Funds located outside the ‘Golden Triangle’ of London, Cambridge and Oxford with a 2002-2015 vintage year deliver higher returns (DPI 1.65, TVPI 2.02) than those within (DPI 0.85, TVPI 1.74)

- British Business Bank-supported funds are largely performing in line with the wider VC market:

- British Patient Capital pooled DPI returns of 0.18 are slightly higher than the wider VC market for funds of the same vintage.

- While Enterprise Capital Fund DPI performance lags the market, the TVPI returns for other LP investors of 1.65 is slightly ahead of VC funds of the same vintage.

- Fund managers are optimistic about quality of deal flow, but have mixed views on exit and fund-raising conditions:

- 36% of surveyed fund managers rate deal flow quality in the current venture capital market as ‘very good’ with the rest saying it is ‘good’.

- 60% of fund managers rate current exit conditions as ‘positive’, but 36% rate it as negative.

- 41% of fund managers are positive about fundraising conditions, but an equal proportion hold negative views.

- 86% of fund managers have changed their investment process to adapt to Covid-19.